Recently, my friend was bragging about how he timed the market perfectly.

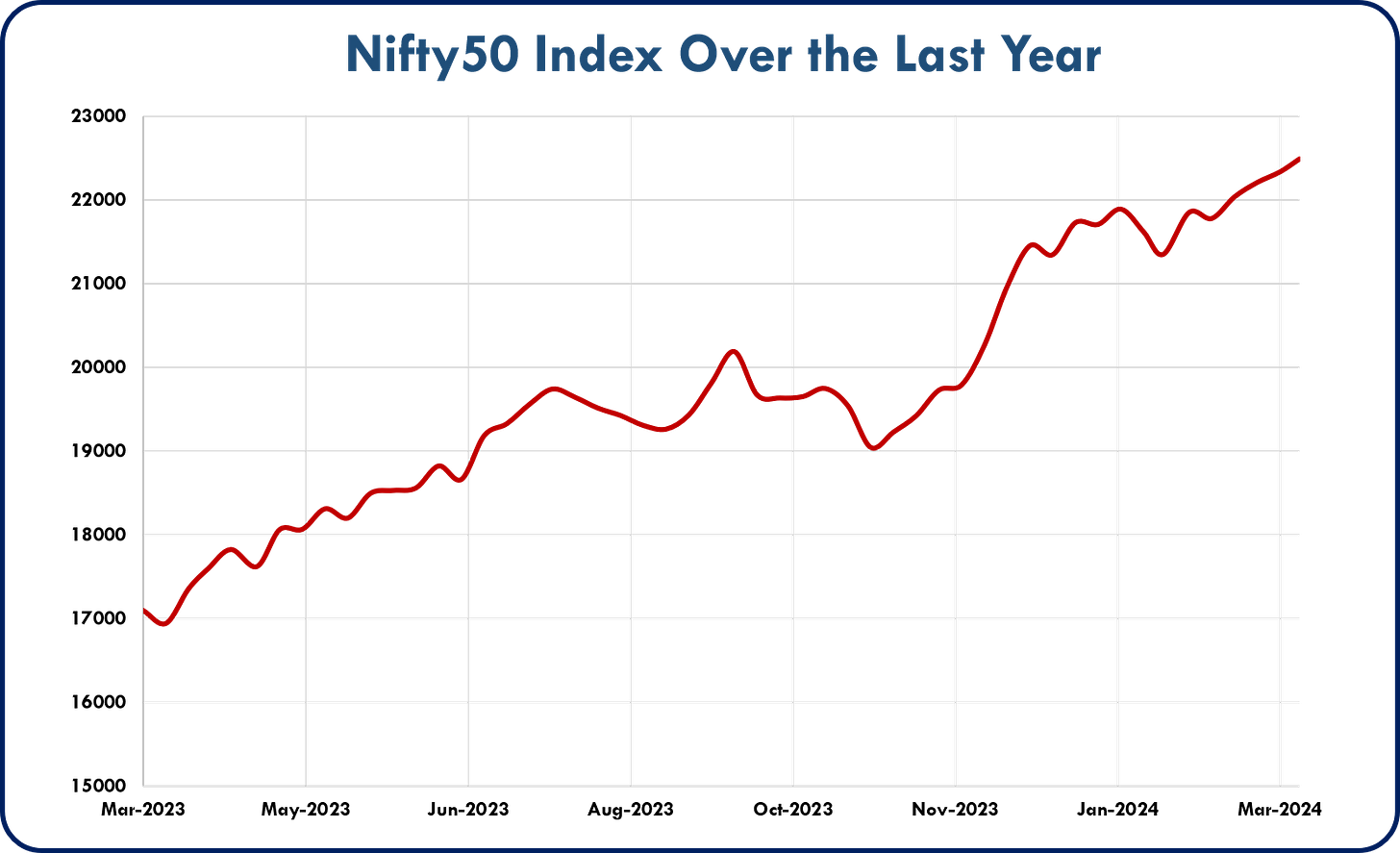

He had put quite a lumpsum in Nifty when the index fell below 19,000 in October 2023, after breaching 20,000 in September. Now, as of March, Nifty has breached 22,000 already and is still going strong.

While my friend was waiting for his "Investor of the Year" award, it got me thinking. What if we only buy the dips? Whenever the stock/index falls below its all-time high, we buy. Does this buy-the-dip strategy beat the typical SIP route?

I wanted to test.

So here is what I did. I pulled up the last 25 years of Nifty 50 data into a Google Sheet. Why 25 years? It's a reasonably long period. And, Google Finance has weekly data only for the last 25 years.

What I am testing:

Does buying the dips beat traditional SIP investing?

While the methodology is not perfect, here is how I went.

Methodology

I now have the last 25 years of Nifty 50 price data to backtest.

Here are my assumptions:

Starting with 100, a weekly amount is available for investing. The amount increases by 5% every year.

For the cash held and not invested in the market, an annual interest of 8% (APR) is added. Which translates to 0.154% weekly (I know that's not exactly how it works, but it makes my calculation easier).

Once invested in the stock, we are not withdrawing. Why? Cuz long-term compounding is the greatest wonder of the world. Also, it’s easier this way.

No taxes, brokerage charges, management fees, or any other charges. It's a good world.

Now let's get to the two strategies I am comparing:

Strategy 1: SIP

Every week the money available (starting from 100 and raised 5% every year) is invested into the market. Doesn't matter what situation the market is in. We close our eyes and put in the money. That's how SIP works right?

Strategy 2: Buy the Dip

The cash we receive every week is held and parked into a bank account which gives us 8% annual interest (APR to be precise).

When the stock market price dips below 20% of its all-time high, we invest all the funds available to the index. All the cash available.

We keep doing the same. Hold the cash and invest only if the price is below 20% of the all-time high. Also, we don't withdraw from the stock market ever. What's invested stays invested.

If this is all complicated, just remember:

Strategy 1: SIP investing - putting money in the market regularly.

Strategy 2: Buy the dips investing - we hold the cash and go all in when the stock dips.

The Result

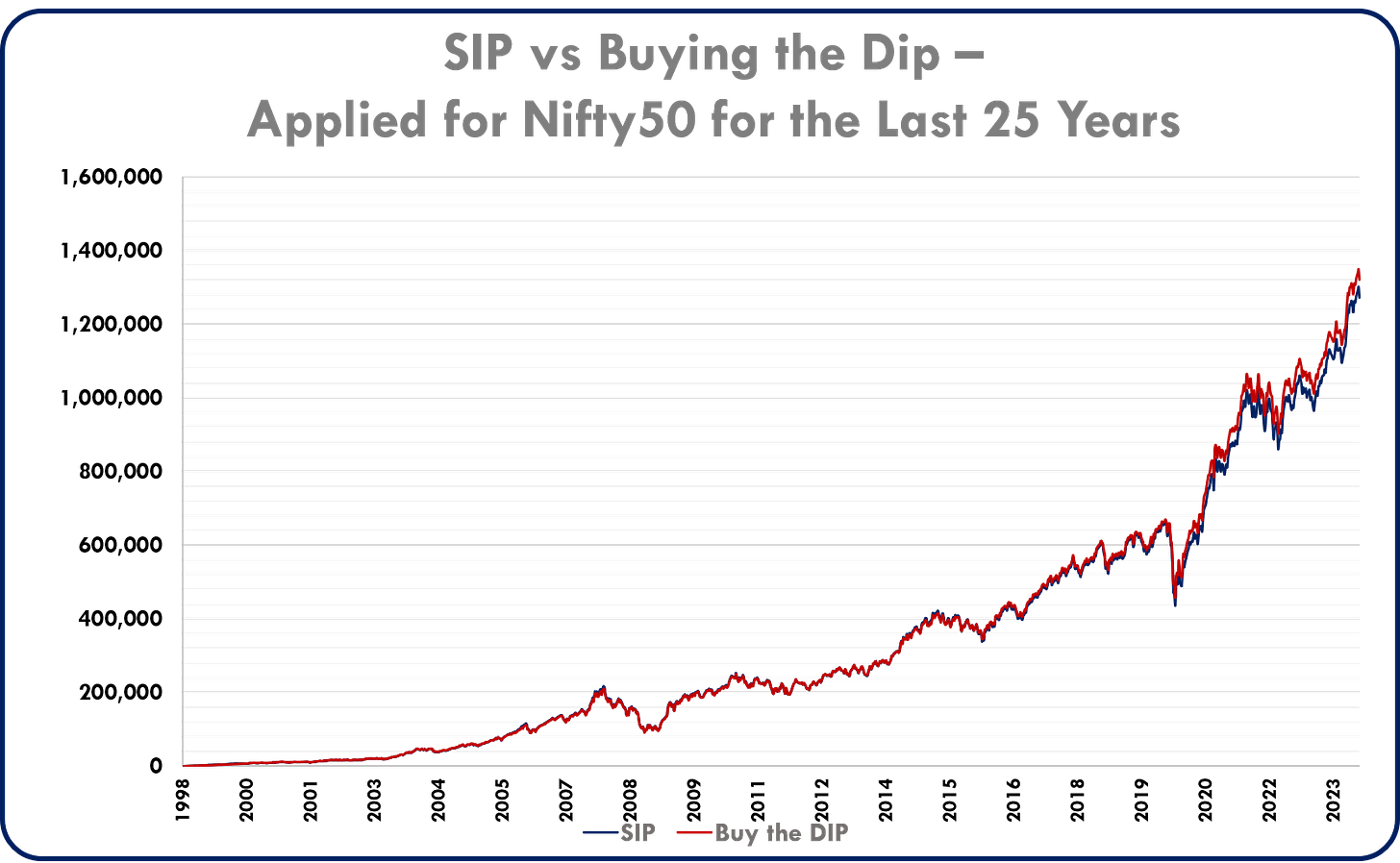

Now that it's all sketched out, I did the calculations. Added a chart. And checked the final value after investing for 25 years (sadly not literally).

Which strategy do you think won in this backtesting?

Take a guess. Strat 1: SIP? Or Strat 2: Buying the dips?

.

.

.

It turns out - both return around the same amount.

Yup. You heard that right. Both gave almost the same returns. In fact, buying in market dips had a slight edge.

That was surprising for me. As a boglehead, I thought a simple SIP would eat this active buying-the-dip strategy.

But as it turns out, buying when the market dips or crashes is a smart play. Hmmm, maybe my friend deserves that Investor of the Year award after all.

It Does Work

I also did play around with the numbers. I started with cash parked getting no savings interest, and then added 8% interest for it. But even with 0% savings interest, the strategy holds good. It's not the savings interest that's doing the heavy lifting.

I also changed when to buy. In the above case, it was a 20% dip from the market's all-time-high (ATH). I took 20% as the initial case because a market crash is usually associated with a 20% decline. A 5% or 10% as the tipping point felt too hasty. And 30% or 40% felt too rare - there won't be much investing there.

Turns out, buying at a 30% decline worked the best in the last 25 years with Nifty50.

Again, this number holds no meaning since it's a backtest. Precise but pointless.

The takeaway is - that buying the dips is a solid investing strategy. To the point, it goes toe-to-toe with SIP. That's what this backtesting reveals.

Of course, SIP still wins though. It's passive. You get the same returns as other active strategies by not even looking at the Nifty price. You can close your eyes and sleepwalk through the crashes and bull markets and still come out on top.

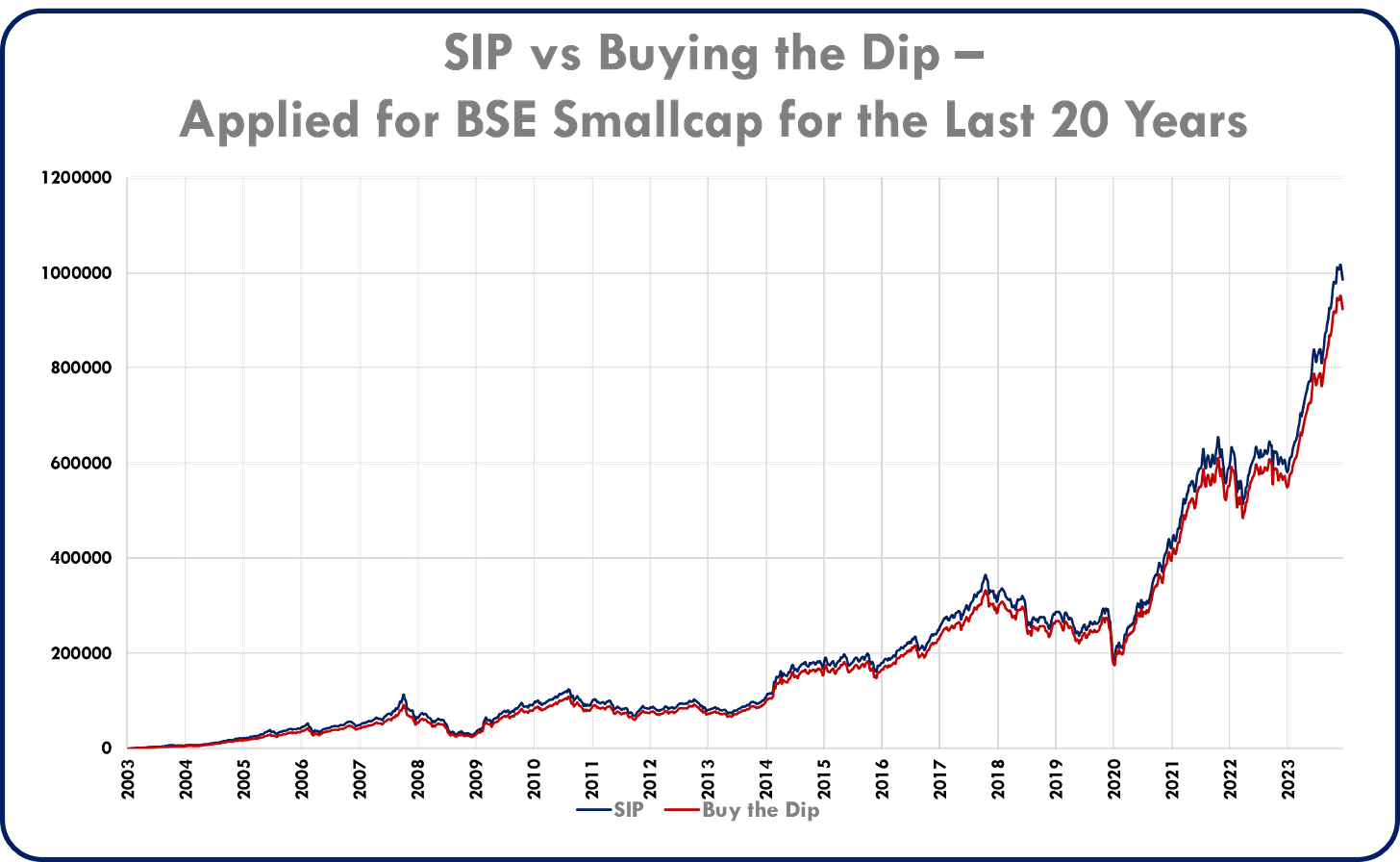

Repeating the Same for Small cap Index

I repeated the same steps for BSE small cap index. The index data available was only for the last 20 years. So the final amount is not comparable to the Nifty50 data above.

Here is what it looks like for small caps:

Here SIP beats Buy the Dip strategy. But not by a huge margin.

In either result, you start to appreciate SIP more and more, to be honest.

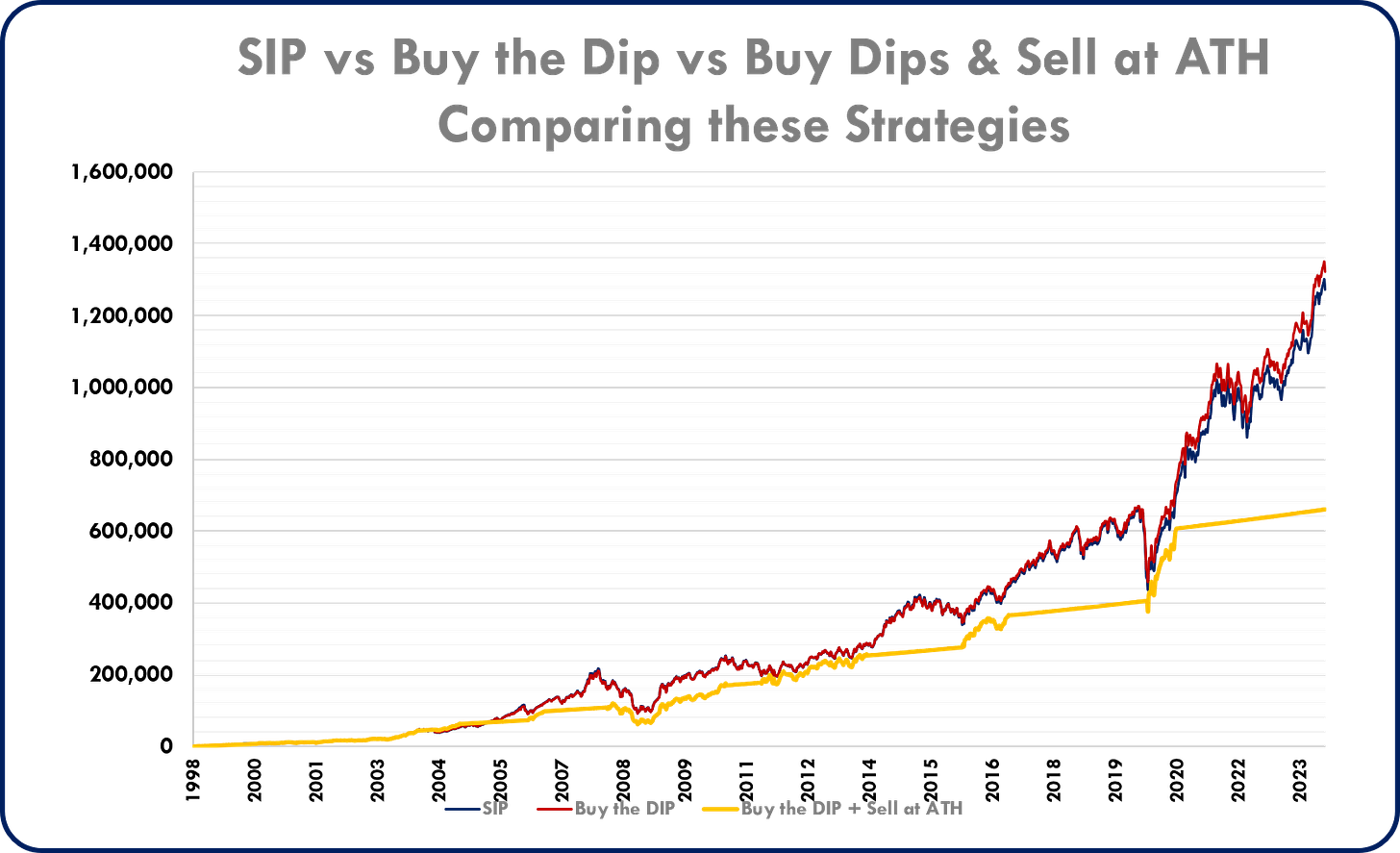

What If We Withdraw at ATH

I added one last thing to this study. The buy the dips strategy assumes once you have put in the money in the stock market you won't withdraw it. It's only the new cash you are holding and looking for the right time to buy (i.e., when the market crashes).

What if, we withdrew money from the stock market whenever the market hit an all-time-high (ATH)?

So, same strategy as buying the dips, but also withdrawing from the stock market when it hits an ATH.

The results are underwhelming though.

So - not participating in the market is a bad idea. Why does this happen? Well, in a bull market, one ATH leads to another ATH. Since I am withdrawing at the first ATH, I am missing out on the bull runs. That's why withdrawing is a bad idea.

Wrapping Up

If it's all too numberyy for you, here are the takeaways-

SIP is still the king compared to other strategies - partly because it still comes out on top and partly because you don't have to think.

Buying the dips turns out to be a good strategy. The returns were similar to SIP investing returns.

Buying the dips and withdrawing at all-time-high is a poor strategy. You miss out on the bull run gains.

That's it for now. If you want to play around the numbers, here is the Google Sheet. Make a copy and use it. One condition though. Please subscribe. And please forward this post to your friends.

Disclaimer: Nothing written here is investment advice.