It’s 1995. A few years into the most consequential economic reform of independent India.

Securities market regulator SEBI was established in 1992, In April 93’ NSE started operations. Licenses were issued to 10 private banks including HDFC and Axis in 1993. IT revolution had just begun with Infosys going public in 1993.

The plumbing for a capital market boom starts to become clear.

A couple of blokes at ICICI’s capital markets team had front-row seats to these changes, they saw this as a massive opportunity. So in 1995, they quit their jobs and started an investment banking company, Edelweiss Financial.

Today Edelweiss is a diversified financial services company with 8 business lines, still run by founders Rashesh Shah (Chairman & CEO) and Venkat Ramaswamy (Vice Chairman).

Business Today

In the early days, Edelweiss largely remained an investment banker for private companies and slowly expanded into adjacencies through the years. As a participant & facilitator in the capital markets, it wasn’t probably hard for Edelweiss to time their IPO to perfection. Edelweiss listed at the peak of the Indian capex boom in December 2007 with a market cap of over $1.5 billion. Its market cap today after 16 years of listing is $850M.

[Lehman brothers was also a large shareholder in Edelweiss pre-IPO]

Post IPO, the company has done a ton of M&A which has shaped the company's trajectory. Some key ones are:

JV with Japanese Insurer Tokio Marine to start Edelweiss Tokio Life Insurance Company in 2010 with Edelweiss owing 74% of the JV.

Acquisition of JP Morgan’s mutual fund business in 2016 which had 7000 crores of assets under management.

A stake sale of 20% of the Asset Reconstruction business to Canadian Pension fund CDPQ in 2016

A 51% stake sale of the Wealth Management business to PAG for a post-money valuation of 4400 crores in 2020.

The Wealth Management business (now rebranded as Nuvama Wealth) was spun out to shareholders last year. But Edelweiss retained 14% of Nuvama which today is worth 2400 crores.

While the company has tried to expand beyond credit, it is still largely a lending business with over two-thirds of the net worth tied to the credit business.

Post the IL&FS crisis, the market has been brutal in valuing Edelweiss. Stock is down 80% from the peak made in 2018. Before the spin-off of the wealth management business last June, Edelweiss had a market cap of 6500 crores. The wealth management business was alone worth 8000 crores.

Why does no one like the stock?

While we can’t be 100% sure why some stocks underperform, we can make some educated guesses. Here are some of the reasons that I attribute the underperformance to.

Narrative change / Story pivot

Rashesh Shah, like most CEOs operating at the highest level, is an articulate salesman who is brilliant at telling stories. Until around 2020, Rashesh kept up the narrative that Edelweiss is largely a credit business. They were growing at high rates with ROEs north of 20%. Their earnings presentations were full of graphs with exponential growth curves, which made everyone feel good.

Who can blame Rashesh, credit businesses, especially ones into housing were in fashion in those days. Even after the likes of DFHL and Indiabulls housing got in trouble, Rashesh projected confidence and expected growth to continue. At the end of FY19, management's outlook was to “at least” double the credit book by FY22.

What transpired over the next 3 years made this guidance look laughable. While the business was already in trouble post-IL&FS crisis, the pandemic just made it worse. As the saying goes, it’s always dark before it goes pitch black. In 2020, Edelweiss also experienced severe refinancing issues with ALM mismatch like many other NBFCs at the time, due to issues in the real estate market & pandemic-induced moratorium. Edelweiss booked a massive 2044 crore loss for FY20.

Things were so bad that many questioned if Edelweiss would survive the pandemic. Rashesh was forced to sell stake in the Wealth business, the crown jewel of the Edelweiss group at the time. Rashesh was probably forced by prevailing conditions to flip on the old narrative completely.

By the end of FY21, the stated key focus of the management was strengthening the balance sheet (reducing debt), reducing wholesale credit exposure, and maintaining asset quality.

Many investors piled on during the boom days of 2017/18 believing the hype and seeing the business as a high-growth NBFC. Investors loathe promoters who over-promise and under-deliver. Here Rashesh almost ran the business to the ground. It’s no surprise investors don’t trust the company today.

Business degrowth/Stagnation

Business stagnation is probably the 2nd worst thing for an investor after a deceitful promoter. No one likes to own companies that are not growing, especially in a market like India where all credit businesses are growing at 15% CAGR.

Edelweiss’ net worth has been stagnant for the past 5 years.

This is a major problem. While many of the underlying business verticals have grown, the credit business has de-grown. Management is expected to continue to wind down the wholesale credit business, so we are unlikely to see a pick-up in net worth soon.

With credit businesses becoming increasingly less relevant for the Edelweiss group, perhaps net worth is also a less relevant metric. Anyway, as long as the business doesn’t grow, investors will likely continue to be uninterested.

Fraud Allegations / Question marks on Rashesh Shah

In January 2020, Rashesh Shah was summoned by ED for a probe into alleged FEMA violation. A Mumbai-based company Capstone Forex, allegedly created bogus tourist lists and illegally remitted foreign exchange overseas. To provide credit balance to this company, Edelweiss Group companies and another firm under probe allegedly issued cheques to Capstone for buying dollars. These dollars were remitted to shell companies, which subsequently withdrew the money mostly through cash.

Investment banks facilitating potential illegal activities is nothing new. European banks are routinely caught with such crimes. It usually ends with some fines and is not an existential risk for the facilitator entity.

This allegation came at a time when the company was facing its own liquidity challenges. Had the company gone down, it wouldn’t have been surprising to see Rashesh Shah in prison. After all, India has a rich history of criminalizing business failure, just ask Naresh Goyal. Now that Edelweiss doesn’t face an existential business risk, it’s unlikely to cause a major issue.

There was also the Anugrah scam in 2020. Edelweiss has been a clearing member since 2018 and has been providing clearing and settlement services to brokerages and trading members. Anugrah was the client of Edelweiss, who provided clearing services to Anugrah only for the trades executed on the future & options (F&O) segment of the NSE. Anugrah provided shares as collateral towards the margin required for the settlement of trades. Due to trading losses in 2020, Anugrah failed to meet its margin obligation and owed Edelweiss around 460 crores. Edelweiss sold the collateral to recover the amount. There was just 1 problem, Anugrah was a broker and had used client shares as collateral. You can’t just sell shares of retail investors! The matter went to court and Edelweiss has been asked to return the original shares to investors. Edelweiss knew that the collateral it had received was shares of the broker’s clients. It simply didn’t care. The whole episode clearly shows Edelweiss is willing to do shady things to grow its business and protect itself. This part of the business is now within Nuvama and one can only hope that these practices are no longer in play with reputed foreign promoters in charge.

In another case last year, an FIR was registered against Rashesh Shah and the CEO of Edelweiss ARC for the death of Nitin Desai. Nitin Desai reportedly committed suicide after ARC moved to seize Desai’s art studio for non-repayment of loans. Nithin Desai is well-known in the movie industry. Due to the high-profile nature of the case, it will likely be investigated thoroughly. Nitin Desai owed 252 crores including interest, not sure what people think ARCs do, seems standard procedure to me for them to push for recovery and seize assets. Probably a good lesson for everyone to live below one’s means.

Net Net, I think Rashesh is in a number of complicated financial businesses. Edelweiss employs over 10,000 people and it’s possible for there to be someone breaking the law at any time. Would any of it kill the company now when business verticals are fully independent? Seems unlikely to me.

Reason to own

While there are many reasons to sell a stock, there is often only 1 reason to buy. The company is undervalued relative to the value of the underlying businesses and is set to take off over the next few years. But I will get into a couple more reasons below.

Management is walking the talk now

After the COVID shock in FY21, management set 3 key priorities for the business.

Spin off & listing of the wealth management business.

Reduction in credit book and debt

Continued scale-up of non-credit businesses.

Post sale to PAG, Edelweiss retained 44% of the wealth management. Edelweiss promised to spin off the remaining stake to shareholders in an IPO, to unlock value for shareholders. The IPO did happen, but was 6 months delayed and Edelweiss retained 14% of their stake to be sold later in the open market.

The rhetoric on the wholesale reduction has been to wind down the book and bring down the overall leverage. Debt levels have been coming down and management is confident to bring it further down over the next 2 years. Debt to equity was roughly 6 in 2019, now it has come down to around 2. Over the last 5 years, Edelweiss has paid down around 25,000 crores of debt.

All the non-credit businesses continue to grow at high rates. The alternative assets, general insurance, and mutual fund businesses have grown revenues at over 30% CAGR over the last 5 years. The life insurance business has also grown at mid-teens despite the industry facing headwinds during COVID.

A play on Sunrise industries

While the credit businesses have hogged the headlines, Edelweiss does have some exciting financial services businesses. Let’s take the mutual fund business for example. 8 years ago, Edelweiss barely had any presence in the mutual fund business. After acquiring JP Morgan’s mutual fund business in 2016, Radhika Gupta was appointed CEO. Radhika’s tenure has not only seen rapid AUM growth but has also seen Edelweiss become a relevant brand in the MF space.

A large part of this AUM growth has come from the launch of the Bharath bond ETF in 2019. Bharath bond ETF was the first debt ETF in the country, allowing retail investors to buy debt from PSU companies at a very low cost of 0.0005%.

Even without the Bharath Bond ETF, Edelweiss’ AUM growth has fast outpaced the industry by a wide margin. Radhika so far has been a brilliant CEO, she has rightly understood that building relevance and a brand name are more important for Edelweiss in the early days vs AUM growth. The fund house has not relied on star fund managers and has co-fund managers for all its schemes. They have not been afraid to launch industry-first innovative products.

After making losses for 8 years, the business reported its first-ever profit in H1FY24. The mutual fund business has great economics at scale, so expect profitability to grow rapidly over the next 5 years with the growth in AUM. Let’s not forget that the mutual fund industry is growing at 15% with Indian savings starting to financialise. Indians even today have most of their assets in bank deposits or real estate with mutual funds only making up 9.7% of assets. The growth in the industry and the growth for Edelweiss is likely to continue for a very long time. It would not surprise me if the mutual fund business is a unicorn by 2030.

If the mutual fund industry in India is a teenager, the private alternatives assets industry is a baby just born. While the industry has seen a massive boom in the last decade, alternative assets as a % of GDP are still at 3% in India, compared to 25% in North America. The below image shows the growth in private alternatives in India since 2010.

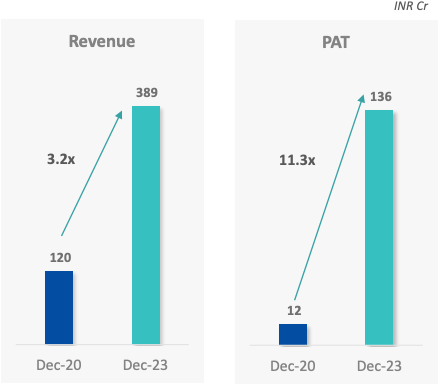

The industry is expected to grow another 8x over the next decade. Edelweiss has already built a highly profitable business in alternatives. The business has both high growth and high margins. Profitability has increased exponentially with scale over the last 3 years as seen below.

Edelweiss is also rapidly building a presence in the insurance industry. The general insurance arm now named Zuno serves over 3 million customers with AUM of over $100M. It constantly features among the top 10 fastest-growing general insurance companies.

The life insurance business started in 2010 has AUM of nearly a $1B and is expected to be profitable by FY26. The insurance business has a long gestation period and requires huge capital and a long-term mindset to be successful. So far Edelweiss has been patient and has continued investments even in difficult times with a view to the future. Business is now maturing and poised for profitable growth.

It’s still early days for both insurance and asset management, Edelweiss has invested nearly a decade in building them, so it just might be the time to cash in. Edelweiss also has a housing finance business, which can be another growth driver. I won’t get into it here as none of you probably want to own any NBFC lenders.

Some of the parts is worth more than the whole

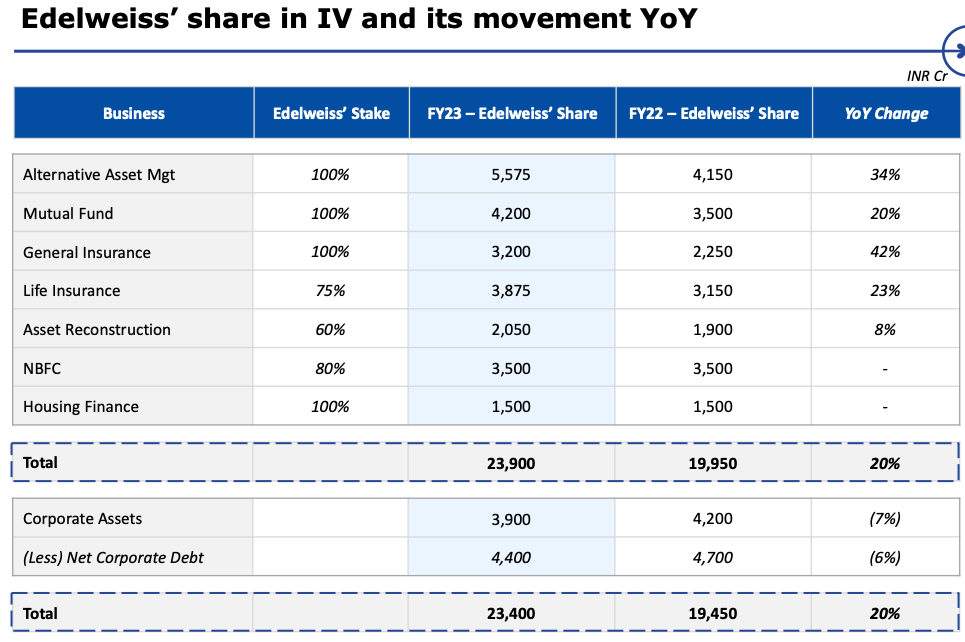

With the management trying to position the company as a financial holding company vs a lending NBFC earlier, the sum of the parts method becomes a more relevant valuation technique. Management is aware of this and didn’t miss the opportunity to showcase how the stock was undervalued in last year’s AGM.

At the AGM, they had a presentation on their estimate for the intrinsic value of the business.

Management self-assessed the business to be worth roughly $3B, over 3x the current market value. Even if you assume management is overvaluing the business by 50%, the market value is still too low.

Look, as some of you must be rightly thinking, it’s a holding company, it should trade at a discount, just like every other holding company in the India. Holding companies trade at a discount generally because most of them don’t pay dividends and shareholders are unlikely to realize the net asset value directly through spin-offs or demergers.

With Nuvama's spin-off, Edelweiss has shown proof that Rashesh is serious about unlocking value for shareholders. Other businesses are likely to follow suit over the coming years as they scale and hit stable growth rates. Edelweiss also pays dividends every year. With this evidence of value unlocking, it makes no sense for Edelweiss to trade at a huge discount to underlying value.

Final thoughts

A lot has changed for the company over the past 5 years. Pre covid, before the separation of individual businesses, the corporate office had 600 employees. Today it’s a lean head office with only 60 people.

Business has been through hell and has survived. Post IL&FS days were nightmarish for the company. Imagine being a financial entity leveraged 6x which has to refinance billions of dollars of debt, with the market losing confidence in the industry and your company. Edelweiss is not a big corporate business group like Bajaj or Sundaram which are into multiple industries and are seen more favourably from lenders even in times of distress. Rashesh and the team did what they could to survive and come out of the crisis alive.

What happens to credit businesses after they are done de-leveraging? Management expects to pursue co-lending partnerships with banks. They have already started this a couple of years and it seems to be doing ok.

Here is Rashesh on the Q2FY24 “ …on the co-lending side, we do believe that eventually, if you look at a housing finance, they have about 800 odd crores of equity with some retain earnings over three years we expect, we don't expect to put in more equity in that we won't require. We expect the equity will reach maybe about, 1000 crores, 1,100 crores over the next couple of years. And we do expect that under co-lending, all the modeling we have done, that if we can get to a disbursement of about 5,000 crores to 6,000 crores a year, we can get to about 150 to 200 crore PAT. So, about 15% to 20% PAT is what we would target, which we would get with a 6,000 crore disbursement. Currently, we are clipping along at about 1,500 crore disbursement in that business. But we were half of that a year ago and half of that a year ago, and the same thing is true with MSME. Currently, we have about 500 crore equity allocation to that, but as the wholesale book is getting wound down, we will put another 500-crore equity allocation to that. So, both the co-lending businesses, the housing business and the MSME credit business in, let us say, '26 or so, I would expect that they would have about 1,000 odd crores of equity and should make 150 crores to 200 crores of PAT each. And that is our internal target. 15 to 20 crores or 15 to 20% ROE is possible, and in both of them we are currently at about, in SME we are at about 1,100 crore, 1,200 crore annual disbursements, and in housing we are at about 1,500 crore, 1,600 crore annual disbursements. We are clipping along well. So, if you see the growth rate, I think we should get to 5,000 crore to 6,000 crore annual disbursements by 2026, and at that time we should be able to make this level of profitability.”. You don’t need to believe in any of this to find the business attractive.

Over the last few years, Rashesh has repeatedly expressed the difficulty with refinancing the huge debt and vowed to change the credit business model to co-lending and asset-light. Rashesh and the other insiders own over 40% of the company and Rashesh hasn’t sold his shares for years.

Edelweiss remains an optimistic company run by first-generation entrepreneurs that has had its fair share of troubles. It’s the shady past that has made today’s valuation attractive.

Edelweiss reminds me of European banks that have always done questionable activities for profits. Perhaps some unhealthy greed is part of their DNA. It does seem like they have learned their lesson from the past. Well, at least for now. Many investors are scared by the experience of owning the business in the last cycle.

Will this time be different?

Disclaimer: Nothing written above investment advice